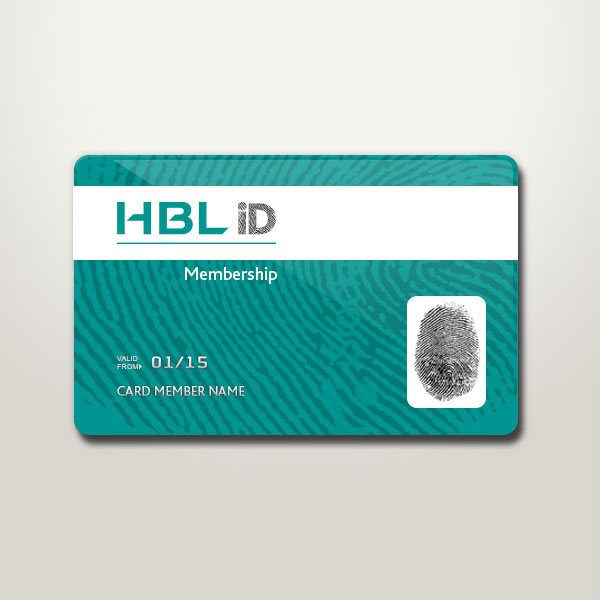

Habib

Bank Limited iD

HBL iD is an account for the youth. HBL iD gives you

some of the most exciting deals and discounts. Dine out at your favorite

restaurants, shop at the trendiest stores or simply top up your mobile credit

through HBL Mobile app to catch up with friends.

Features:

·

Amazing discounts at leading restaurants

and retail outlets.

·

Free debit card issuance

·

No minimum balance requirement

·

Free mobile banking app

HBL

iD Savings Bucket:

A bucket of excitement awaits with HBL iD’s Savings

Bucket, a special feature that helps you earn profit on your short-term

savings. Whether you want to save up for a new cell phone or throw the best

birthday party of your life, all you need is HBL iD.

To apply for a Savings Bucket;

1. Decide

what amount you want to open the Savings Bucket with (no minimum amount

required)

2. Choose

a saving period from 3 to 12 months

3. Set

an amount to fill your bucket each month from your HBL iD Account

You will earn a profit on your savings and when the

saving period ends, the money will be transferred back to your HBL iD Account

for you to use. You can also open two Savings Buckets at a time. Fill out the

request form today and make the most of your savings!

Application

Criteria:

·

HBL iDAccount is applicable for anyone

falling within the age bracket of 18-24 years

·

Document requirement include student ID

card, CNIC and utility bills for address verification.

Comments